Financial statements are formal records of a company's financial activities and position. They include the balance sheet, income statement, and cash flow statement. These documents are crucial for reflecting a company's financial health accurately. They provide a comprehensive view of the company's financial performance and aid stakeholders in making informed decisions. The balance sheet provides a snapshot of a company's financial position at a specific point in time. It consists of assets, which are what the company owns; liabilities, which are what the company owes; and equity, which represents the company's net worth. The income statement presents an overview of a company's revenue, expenses, and net income over a specific period. It helps assess the company's profitability and its ability to generate profits from its operations. The cash flow statement explains the cash inflows and outflows from operating, investing, and financing activities. It is vital for understanding a company's liquidity and its ability to meet short-term obligations. Financial statements are essential for evaluating a company's overall financial standing, identifying risks, and recognizing opportunities for growth. They provide valuable insights into a company's financial health, allowing stakeholders to make informed decisions. Financial statements aid in strategic planning and resource allocation. They provide the necessary information for setting financial goals, making business decisions, and implementing effective strategies to drive the company forward. GAAP provides a framework of accounting principles and guidelines for financial reporting in the United States. It ensures consistency, transparency, and comparability in financial statements, enhancing the reliability of financial information. IFRS are global accounting standards that facilitate international comparability of financial statements. They are designed to provide a common language for business affairs across different countries, making financial reporting more transparent and understandable globally. Financial statements play a pivotal role in corporate finance by providing a comprehensive view of a company's financial performance, liquidity, and overall health. They serve as a crucial tool for stakeholders, including investors, creditors, and management, in making informed decisions and understanding the financial position of the company. Financial statements are important because they provide a comprehensive view of a company's financial performance, liquidity, and overall health. They aid stakeholders in making informed decisions and understanding the financial position of the company. The main types of financial statements are the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of a company's financial position, the income statement presents an overview of revenue and expenses, and the cash flow statement explains the cash inflows and outflows. Financial statements reveal important information about a company's financial health, profitability, liquidity, and overall performance. They provide insights into the company's assets, liabilities, equity, revenue, expenses, and cash flows. Financial statements are typically prepared quarterly and annually. However, some companies may also prepare monthly financial statements for internal management purposes and to monitor their financial performance more frequently. Financial statements are used by various stakeholders, including investors, creditors, management, regulatory agencies, and analysts. They rely on financial statements to assess a company's financial health, make investment decisions, and evaluate its overall performance.Understanding Financial Statements

Definition and Importance

Types of Financial Statements

Balance Sheet

Income Statement

Cash Flow Statement

Role of Financial Statements in Corporate Finance

Assessing Financial Health and Performance

Decision-Making and Planning

Regulations and Standards Governing Financial Statements

Generally Accepted Accounting Principles (GAAP)

International Financial Reporting Standards (IFRS)

Conclusion

FAQs

1. Why are financial statements important?

2. What are the main types of financial statements?

3. What do financial statements reveal about a company?

4. How often are financial statements prepared?

5. Who uses financial statements?

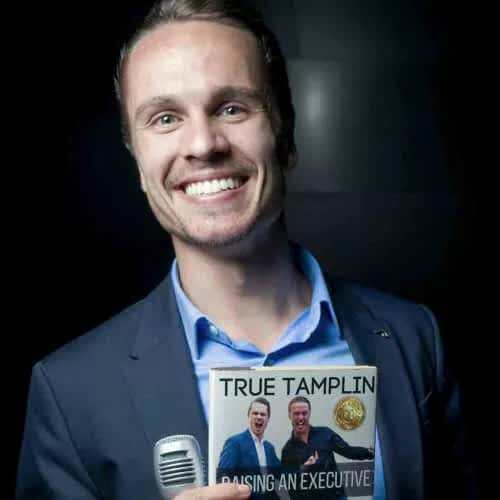

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website.