Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When investors buy bonds, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond's face value at maturity. Bonds play a crucial role in the financial markets by providing investors with a stable and predictable income stream. They are often seen as a safer investment compared to stocks, making them an essential component of a well-rounded investment portfolio. The primary purpose of bonds is to raise funds for various entities, including governments, municipalities, and corporations. They serve as a means for these entities to finance projects, operations, or expansion without diluting ownership as they would by issuing stock. Bonds offer diversification benefits by potentially reducing overall portfolio risk. They tend to have a low correlation with stocks, which means that when stock prices are falling, bond prices may rise, providing a hedge against market volatility. Government bonds are issued by national governments and are considered one of the safest forms of investment. They are often used to finance government spending and are backed by the government's ability to tax its citizens to repay the debt. Corporate bonds are issued by corporations to raise capital for various purposes, such as expansion, acquisitions, or ongoing operations. They typically offer higher yields than government bonds, but they also carry a higher level of risk. Municipal bonds, or "munis," are issued by state or local governments to fund public projects, such as building schools, highways, or hospitals. They are known for their tax advantages, as the interest income is often exempt from federal and/or state taxes. Other types of bonds include mortgage-backed securities (MBS), agency bonds, and international bonds. Each type has its own unique features and risk profiles. The main risks associated with investing in bonds include interest rate risk, credit risk, and inflation risk. Interest rate risk refers to the potential for bond prices to fall when interest rates rise, while credit risk pertains to the issuer's ability to repay the bond's principal and interest. Inflation risk arises from the possibility that the purchasing power of the bond's future cash flows may be eroded by inflation. Despite the risks, bonds offer several benefits to investors. They provide a predictable income stream through regular interest payments, and they can act as a stabilizing force in a portfolio during times of market volatility. Additionally, bonds can offer capital preservation and potential diversification benefits. Before investing in bonds, it's crucial to consider factors such as the investor's risk tolerance, investment goals, time horizon, and the current economic environment. Understanding the different types of bonds and their associated risks is essential for making informed investment decisions. Bonds can play a vital role in an investment strategy by providing income, capital preservation, and diversification. They are often used to balance the risk of a portfolio that also includes stocks and other asset classes. Investors can access bonds through various channels, including purchasing individual bonds through a broker, investing in bond mutual funds or exchange-traded funds (ETFs), or buying bond certificates. Each method has its own considerations in terms of costs, liquidity, and diversification. Investing in bonds can be approached through strategies such as laddering, which involves buying bonds with staggered maturities to manage interest rate risk, or using bond funds to gain exposure to a diversified portfolio of bonds. Additionally, investors can consider factors such as yield, credit quality, and duration when constructing a bond portfolio. In conclusion, bonds are an important investment option for individuals seeking income, capital preservation, and diversification within their portfolios. Understanding the different types of bonds, their associated risks, and how they function within a diversified investment strategy is crucial for making informed investment decisions. While bonds offer stability and income, they are not without risks, and investors should carefully consider their risk tolerance and investment objectives before incorporating bonds into their portfolios. Bonds are generally considered safer than stocks due to their fixed income nature and priority in the event of issuer bankruptcy. However, they still carry risks, such as interest rate and credit risk. Investors can buy bonds through brokerage firms, banks, or directly from the issuer. They can also invest in bond mutual funds or ETFs for diversified exposure to various bonds. Several factors can affect bond prices, including changes in interest rates, inflation expectations, credit ratings, and the overall economic environment. Yes, investors can lose money investing in bonds, primarily due to changes in interest rates, credit downgrades, or issuer defaults. While municipal bonds are often tax-exempt at the federal level, some may be subject to state and local taxes, depending on the investor's place of residence and the bond's issuance location.What Are Bonds?

Definition of Bonds

Importance of Bonds in Investing

How Bonds Function

The Purpose of Bonds

Role of Bonds in a Diversified Investment Portfolio

Types of Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Other Types of Bonds

Risks and Benefits of Investing in Bonds

Risks Associated with Bonds

Benefits of Investing in Bonds

Considerations for Investing in Bonds

Factors to Consider Before Investing in Bonds

How Bonds Fit into an Investment Strategy

How to Invest in Bonds

Ways to Access Bonds

Strategies for Investing in Bonds

Conclusion

FAQs

1. Are bonds safer than stocks?

2. How do I buy bonds?

3. What factors affect bond prices?

4. Can I lose money investing in bonds?

5. Are municipal bonds always tax-exempt?

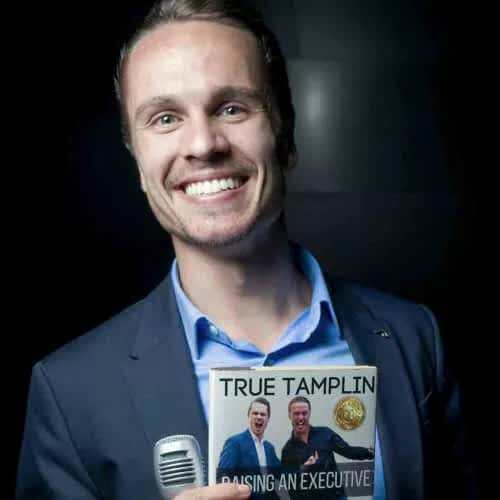

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website.