An annuity is a financial product that provides a steady income stream, typically used as a tool for retirement planning. When you purchase an annuity, you make a lump-sum payment or a series of payments to an insurance company. In return, the insurance company agrees to make periodic payments to you, either immediately or at a later date. Annuities can be used to supplement retirement income, protect against outliving savings, and provide a source of guaranteed income. Annuities play a crucial role in retirement planning by offering a way to convert savings into a reliable income stream during retirement. They help individuals mitigate the risk of outliving their assets, which is a major concern for many retirees. Additionally, annuities provide a hedge against market volatility and can offer financial security during the later stages of life. Fixed annuities offer a guaranteed interest rate for a specific period, providing a predictable, regular income stream. The insurance company assumes the investment risk and guarantees the principal and a minimum interest rate. Variable annuities allow the annuitant to allocate funds to different investment options, such as mutual funds. The income received during the distribution phase fluctuates based on the performance of the chosen investments, making it a more market-sensitive option. Indexed annuities provide the opportunity to earn returns linked to a market index, such as the S&P 500, while also offering downside protection. These annuities can provide a balance between potential market-linked growth and a level of protection from market downturns. During the accumulation phase, the annuitant makes payments into the annuity, which then grows tax-deferred until the distribution phase begins. This phase allows the annuity to accumulate value over time. In the distribution phase, the annuity pays out regular income to the annuitant. This phase can last for a specific period or for the annuitant's lifetime, depending on the chosen payout option. Annuities offer tax-deferred growth, meaning the earnings on the investment are not taxed until they are withdrawn. However, withdrawals are taxed as ordinary income, and early withdrawals before age 59½ may incur a 10% IRS penalty. Annuities provide a predictable income stream, offering financial security and peace of mind during retirement. This feature helps individuals plan their expenses and maintain their lifestyle without the fear of outliving their savings. The tax-deferred nature of annuities allows the investment to grow faster since taxes on the investment gains are postponed until distributions are made. This can result in greater overall growth compared to a taxable investment with the same return. Certain annuity options provide benefits to beneficiaries after the annuitant's passing, ensuring that any remaining funds can be passed on to loved ones. Annuities often come with various fees, including annual expenses, mortality and expense fees, administrative fees, and surrender charges. These fees can eat into the overall return on the investment. Annuities are designed to be long-term investments, and early withdrawals may result in surrender charges or penalties. This limited liquidity can make it challenging to access funds in case of an emergency. The fixed income provided by some annuities may not keep pace with inflation, potentially reducing the purchasing power of the annuitant over time. Annuities offer a reliable income stream, which can complement other sources of retirement income such as Social Security, pensions, and investment accounts. This can help retirees maintain their standard of living throughout retirement. When strategically integrated, annuities can provide a layer of stability and protection against market volatility, ensuring that retirees have a portion of their assets dedicated to a predictable income stream. It's crucial to assess individual retirement goals, risk tolerance, and financial situation when selecting an annuity. Factors such as payout options, fees, and surrender charges should be carefully considered to align the annuity with retirement objectives. Annuities can be evaluated based on their potential to provide a secure income stream, tax advantages, and estate planning benefits. It's important to assess the overall financial objectives and risk tolerance before considering annuities as an investment. Annuities carry investment risks, including market risk and inflation risk. Understanding these risks and their potential impact on the intended investment outcome is critical for making informed investment decisions. Before investing in an annuity, individuals should evaluate whether the features and benefits align with their specific financial goals, risk tolerance, and investment time horizon. Annuities can play a crucial role in providing long-term financial security by offering a reliable income stream during retirement, protecting against market volatility, and addressing the risk of outliving savings. When incorporated into a comprehensive financial plan, annuities can serve as a valuable tool for diversifying retirement income sources and managing longevity risk, enhancing the overall financial well-being of individuals. Given the complexity of annuities and their implications for retirement planning, seeking advice from financial professionals, such as certified financial planners and insurance advisors, can help individuals make well-informed decisions aligned with their financial goals. In conclusion, annuities offer a valuable means of securing a steady income stream during retirement, providing financial stability, and addressing the risk of outliving savings. While they come with advantages such as guaranteed income and tax-deferred growth, it's essential to carefully consider factors like fees, limited liquidity, and inflation risk. By integrating annuities into a comprehensive retirement plan and evaluating them as an investment, individuals can enhance their financial security in retirement. Seeking professional guidance is crucial to ensure that annuity decisions align with one's long-term financial goals. A: The minimum age to start receiving payments from an annuity is usually 59½ to avoid early withdrawal penalties. A: Some annuities allow additional contributions after the initial purchase, while others do not. It's important to check the terms of the specific annuity contract. A: Annuities offer tax-deferred growth, meaning the investment grows tax-free until withdrawals are made. However, withdrawals are taxed as ordinary income. A: The remaining funds in an annuity can be passed on to beneficiaries, depending on the specific terms of the annuity contract. A: Most annuities allow for surrendering the contract and receiving a lump-sum payment, but surrender charges and tax implications may apply.Understanding Annuities

Definition of Annuity

Importance of Annuities in Retirement Planning

Exploring Annuity Types

Fixed Annuities

Variable Annuities

Indexed Annuities

Annuity Mechanics

Accumulation Phase

Distribution Phase

Tax Considerations

Advantages of Annuities

Guaranteed Income

Tax-Deferred Growth

Survivor Benefits

Disadvantages of Annuities

Fees and Expenses

Limited Liquidity

Inflation Risk

Annuities in Retirement Planning

Annuities as a Retirement Income Tool

Integrating Annuities in a Comprehensive Retirement Portfolio

Choosing the Right Annuity for Your Retirement Goals

Annuities as an Investment

Evaluating Annuities as an Investment

Understanding Risks and Returns

Assessing Suitability for Your Financial Goals

Annuities and Financial Planning

Role of Annuities in Long-Term Financial Security

Incorporating Annuities into a Holistic Financial Plan

Seeking Professional Guidance for Annuity Decisions

Conclusion

FAQs

What is the minimum age to start receiving payments from an annuity?

Can I add funds to my annuity after the initial purchase?

Are there any tax benefits associated with annuities?

What happens to the remaining funds in an annuity after the annuitant passes away?

Can I surrender my annuity and receive a lump-sum payment?

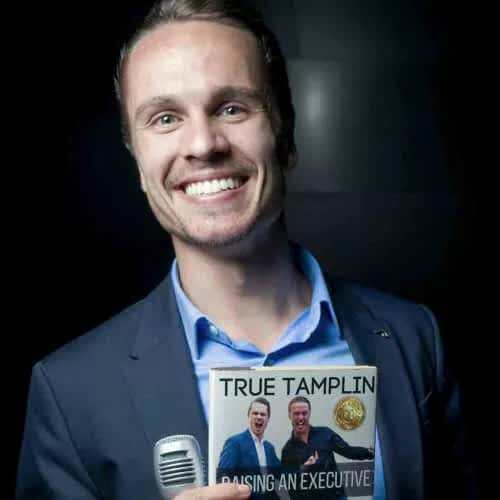

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website.